A List Of Passwords is NOT a Digital Asset Estate Plan

Today’s popular advice is to leave a list of online accounts and passwords, or leave access to a password manager, as a way of providing your loved ones with access to your data and online accounts when you die.

Many people suggest that this list of accounts and passwords is the Digital Asset Estate Plan. They focus on the fiduciary duty of the executor or successor trustee to take care of all of the assets of the deceased and they worry about obtaining quick and predictable access through online accounts. Although accessing the online accounts of the deceased is a post death administration strategy, it’s not the only strategy and it’s certainly not the only legal issue.

A list of passwords is not a digital asset estate plan because it’s not enough and too much at the same time.

A list of online accounts and passwords is not enough to be called a Digital Asset Estate Plan because it doesn’t give the person who finds it enough information. There should be a valuation with each account (what is it used for?) and a devise or actual notes on what you wish to have happen to the account when you die.

To fix this, add a column to your list of accounts and passwords directing people what to do with your accounts when you pass away. Consider putting all accounts that should be deleted at the time of your death in one clearly marked list.

A list of accounts and passwords, or an inventory, is not enough if it doesn’t provide ownership details. Information on how to access something without clarifying ownership rights is not enough because it may put your named executor, trustee, or loved one in jeopardy. Although they may have a fiduciary obligation to take control of your assets and maximize value before distribution to your beneficiaries; a fiduciary duty does not give anyone permission to break the law or not be considerate of the privacy or ownership rights of others.

Include ownership information with lists of digital assets. The same way you would consider whether you share a bank account with a spouse, child, or sibling in determining what will happen to that account when you die; consider whether you own the asset, if someone else owns the asset, or if you only have a right to access the asset during life. This can reduce the likelihood of conflict and preserve the ownership rights you believe in as evidenced by your sharing ownership with that person presently.

A list of accounts and passwords is too much, because there are many notable risks in leaving your passwords for someone. By providing passwords, especially without other notes for what the account is for, you are inviting people to access your accounts. Some accounts might represent things you have a right to transfer. Other accounts might not be transferable by contract or nature. If your executor or successor trustee accesses other people’s private data or information, there may be liability attached to that action. You may think this is trivial and for many accounts it may be. However, for other accounts, you could be inviting your trustee or executor to violate other’s ownership or privacy rights.

Consider not leaving passwords with your list of accounts.

Recent Articles

“Roll Me Up and Smoke Me When I Die”

Willie Nelson with a fan in Austin-Bergstrom International Airport by Henry Yip Willie Nelson's 'gospel' song "Roll Me Up and Smoke When I Die," which is also the title of his auto-biography, lays out his wishes for 'funeral' and disposal, or final disposition of his...

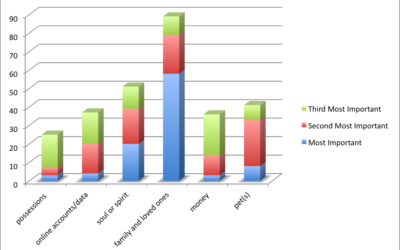

What Concerns You Most about Death?

Last year, with The Sacred Dying Foundation, we sent out a quick survey via email and social media. We asked 2 questions – The first question prompted participants to rank a list of 'priorities' or 'responsibilities' based on what concerned them most when they thought...

Why Do Technology and Elder Law Need Each Other?

Technology needs elder law, because growing old and dying is an experience that 100% of technology users will face. Technology needs elder law to help people make plans for illness, incapacity and death. Elder law needs technology, because human problems need...

0 Comments